All individuals can contribute to the Home and Development Mutual Fund (HDMF), more commonly known to many as PAG-IBIG, when they reach 18 years old. For all employees, HDMF contribution is automatic as soon as they are hired by a company and start earning a salary—it comes in the form of a deduction from the employee’s pay.

The goal of PAG-IBIG is to provide every Filipino with both savings and shelter. It helps its members by returning the members’ monthly contributions + their employers’ contribution in their behalf + any dividend earned by the money after a certain period of time, such as:

- After 20 years since the member started contributing

- At the time of the member’s retirement

- When he is no longer able to work because of injury, illness, or insanity

- After 20 years since the member started contributing

- At the time of the member’s retirement

- When he is no longer able to work because of injury, illness, or insanity

When a member decides to leave the country for good, he has the option to claim his HDMF benefits before departure. And when a member dies before he is able to claim any benefit from HDMF, the amount due to him will then be divided among his beneficiaries. Aside from these, PAG-IBIG allows members to file for housing loan and to increase their monthly contributions in order to get more savings.

Source: https://amaranthbiz.files.wordpress.com/2013/01/hdmf-sched-of-contributions-final.jpg

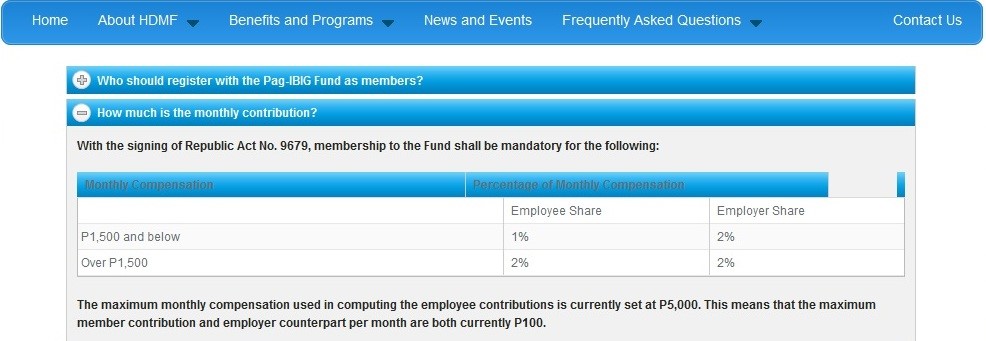

The table shows the employee’s contribution to PAG-IBIG to be computed as 2% of his salary (or 1% if he is earning Php1,500 or less). The employer will match the said amount and will also contribute to PAG-IBIG for the paying employee.

It is important to note that the maximum compensation considered in computing a member’s monthly PAG-IBIG contribution is Php5,000, which equates to Php100 contribution each for the employee and the employer. This means that even if the monthly compensation of an employee exceeds Php5,000, his contribution will remain at Php100.

Small details like this can make for computing the HDMF employee contribution confusing for employers. Because of this, many of today’s businesses are already investing in payroll software in order to automate their payroll computations. It might be time you do the same for your business.

Check out our other blogs for more information on computing your SSS and Philhealth contributions, annualization, and dates to remember when filing taxes.

.png?width=624&name=Sprout-Payroll-Banner-Blog%20(1).png)